One of the key criticisms of the tax on the exercise of power that I recently proposed was that while in principle it made a lot of sense, practically it would be difficult if not impossible to pull off (perhaps requiring a constitutional amendment). In this essay, I want to discuss some of the first principles that inspired that ‘power tax’ and propose a more practical alternative: a radical overhaul of progressive income tax that retains some of the same principles of the ‘power tax,’ and which also (perhaps most importantly) distributes the surplus tax proceeds per capita via a ‘Universal Dividend.’

I have also built and included an interactive model that you can use to toggle some of the key parameters for a radical tax on income, so you can play with alternatives and see how they affect your own income band or compare them to the 2016 US baseline tax scenario.

Background / Why Redistribute?

As I noted in my last essay on taxing the exercise of power, power and wealth tend to naturally distribute across networks according to ‘power laws,’ resulting in a relatively small percentage of the population holding most of the power and wealth. There are a few arguments for why this concentration of power and wealth is destabilizing—or, at the very least, suboptimal—in the long run.

The ecological argument is that “nature loves diversity” and just as the old-fashioned policy of trying to categorically prevent all forest fires ultimately resulted in even worse fires than periodic controlled burns, the concentration of social/economic power in human society leads to an analogous form of homogeneity (of culture, policy, knowledge, etc) that trades more frequent but smaller / distributed risk for less frequent but catastrophic / broader risk. The ‘lite’ version of this argument is just that the homogeneity reduces exploration of competing cultures / policies / ideas and traps us in a local maximum.

The Hayekian argument would be that the concentration of economic power is risky because it’s ripe for seizure and exploitation by a despotic regime.

The historical argument (and perhaps the explanation for the ecological argument) would be that extreme economic disparity, where a large percentage of the population lives in poverty, eventually leads to revolution. Will & Ariel Durant summarize nicely:

The concentration of wealth … regularly recurs in history. The rate of concentration varies (other factors being equal) with the economic freedom permitted by morals and the laws. Despotism may for a time retard the concentration; democracy, allowing the most liberty, accelerates it. The relative equality of Americans before 1776 has been overwhelmed by a thousand forms of physical, mental, and economic differentiation, so that the gap between the wealthiest and the poorest is now greater than at any time since Imperial plutocratic Rome. In progressive societies the concentration may reach a point where the strength of number in the many poor rivals the strength of ability in the few rich; then the unstable equilibrium generates a critical situation, which history has diversely met by legislation redistributing wealth or by revolution distributing poverty.

– Will & Ariel Durant, The Lessons of History (1968)

The Durants’ framing of the practical alternatives—legislative redistribution of wealth vs. revolutionary distribution of poverty—rings true to me. The third option* might be total economic redistribution in a communist state, but I am personally concerned about the feasibility of pure communism. (I am skeptical of both the incentive structures for motivating work and of the ability of any central government to manage the production and allocation of resources in such a state.)

So, given the alternatives (legislative redistribution of wealth, revolutionary distribution of poverty, pure communist redistribution), I tend to favor legislative redistribution of wealth.

First Principles for Income Taxes

One of the key critiques of my tax on the exercise of power—where I argued that the rich exercise power through spending on lobbying, legal services, advertising, and political contributions—was that it would be impractical to enact a ‘power tax’ as legislation, perhaps requiring a constitutional amendment.

In principle I still prefer a tax on trading money for power vs a tax on earnings, but given that we already have all of the machinery in place for income taxes, income tax is a more practical mechanism for dampening power than introducing new consumption taxes on the exercise of power. And, I think we can preserve some of the same principles from my proposal for a tax on the exercise of power by catching things at the other end, with a tax on the accumulation of power.

Now, here are some of what I propose as the key desiderata of a radically reformed income tax.

1. Monotonically Increasing Tax Rate

In the US today, we have progressive income tax brackets, where as you hit certain earnings thresholds, your marginal tax rate increases. In 2016, you paid 10% tax on the first dollar you earned, 15% on the 9,276th dollar, and 39.6% on your 415,051th dollar in earnings.

The idea is that when your total income is lower, you need to spend a higher percentage of your income on basic needs, so you should pay a lower tax rate than someone who earns far more money.

While this is a sensible idea, there are two basic shortcomings.

First, the use of a handful of brackets to “simplify” the computation is outdated. Perhaps there was a time when brackets were simple, but the current tax computation now requires complicated software (and often human accounting advice) to adjust for all of the exceptions. Since everyone has a computer in their pocket anyway, it would be quite easy to do away with the brackets and make a publicly available website where you can just go input your earnings and see your tax contribution spit out.

Second, the existing brackets are a bit arbitrary and max out at a relatively low income. Today, your 4,000,000th dollar in earnings is subject to the same maximum marginal tax rate (39.6%) as your 415,051th, unless we introduce a new tax bracket, which requires a bunch of tedious legislation. You could easily imagine a structure where people earning tens of millions of dollars per year pay far higher than 39.6% in income taxes and still take home a massive amount of earnings post-tax.

We could design a new “Monotonically Increasing” tax formula—this is just math speak for a tax function where every marginal dollar you earn is subject to an increasing percentage tax rate. This would mean your 4,000,000th dollar in earnings would automatically be subject to a higher tax rate than your 415,050th (and your 4,000,001th dollar would be subject to an even higher rate, etc).

Basically, the idea here is to modernize the core principle behind progressive taxes using 21st century software technology. The result would be a “continuously progressive” income tax.

2. Monotonically Increasing Financial Incentive to Earn

I mentioned in the background section that I am skeptical of the pure communist economic system, and I believe financial incentives are a good mechanism for motivating people to work harder (or to do work that is less desirable to do).

We currently have a tax structure that satisfies this principle — after a certain point, for every additional dollar I earn, I keep sixty cents post (federal) tax.*

But you could imagine a tax scheme that does not satisfy this principle—for example, one where there is a cap on the earnings of an individual citizen. While many of us might not be likely to design a tax system with such a cap on earnings, Principle #2 is an important one to keep in mind when designing our formula (as many tax computations that at first blush seem attractive will end up breaking this principle).

To summarize, the basic idea behind this principle is that for every marginal dollar you earn, you take home at least some (perhaps tiny) portion of it post-tax.

3. Alignment of Individual and Collective Returns with a ‘Universal Dividend’

When you combine the first two principles with a per capita distribution of tax proceeds, you achieve what I think is a pretty healthy alignment of incentives.

The basic idea here is as the very rich earn higher and higher incomes, they both (i) are subject to a higher tax rate and (ii) take home more money themselves. And, by redistributing the proceeds of (i) per capita, this means that as the wealthy earn more and more, more and more gets redistributed to the collective citizenry.

Unlike ‘trickle down economics,’ there is no dependency on the high earners injecting money back into the economy via consumption — their high earnings are directly redistributed at an increasingly higher rate the more they earn.

You’ve probably noted the word choice ‘Universal Dividend’ (and the head nod to ‘Universal Basic Income’). I first heard the ‘universal dividend’ phrase in a talk by Mariana Mazzucato and (although she uses it a bit differently), I thought it was a great articulation of the per capita distribution I am proposing.

Now, the two key features of a Universal Basic Income that its proponents tout are that (i) it is universal / per capita and (ii) it is guaranteed (sometimes it’s called a ‘Guaranteed Income’).

The Universal Dividend, on the other hand, would be universal, but the size would be a function of total earnings of the entire population, with no guaranteed floor. The lack of a guaranteed floor on the amount distributed per capita by a Universal Dividend is one of the reasons I like the next principle (zero tax on earnings up to the living wage).

One of the reasons I love the idea of distributing the tax surplus generated by this reform per capita is that it eliminates two arguments I often hear against increasing taxes and redistribution rates.

(i) Re: “I don’t want to pay higher taxes because the government is incompetent and would not put the funds to good use.” Under the Universal Dividend proposal, all the taxes currently collected would fund the same government spends, and, if you are someone that ends up paying a higher percentage of taxes under the proposed formula, all of the new tax dollars you contribute would be directly redistributed to fellow citizens, not spent according to government discretion.

(ii) Re: “How would we pay for a Universal Basic Income?” The Dividend gets set as surplus proceeds generated by the new tax formula relative to the old one — basically, the government budget is set independently from the tax structure, so we wouldn’t be taking money from any other government programs to fund the Dividend. NB: after a few iterations, this relative distinction becomes kind of meaningless and you’d need to have some sort of setup where you set the ratio of government discretionary spending of tax proceeds vs per capita redistribution. The good thing about this scenario, however, is that it would probably promote more citizen oversight of government spending, as all government spending would essentially be trading against per capita distribution. Another alignment of incentives.

4. Tax Free Earnings Up to the Living Wage

While in theory it might be sufficient to choose a tax formula where the growth in the percentage of tax paid as a function of earnings is slow enough that you wouldn’t need to explicitly model in a threshold below which you pay zero taxes, in principle I like the idea of a society where you pay zero taxes on every dollar you earn up to the living wage.

This entails that for the first ~$30k you earn (based on the 2016 numbers) you keep 100% of every marginal dollar you earn.

5. No Loopholes: A Single Rate for Earnings of All Types

The final principle is to treat all earnings equally, regardless of the source. This means using the same tax rate for ordinary income, investment income, long and short term capital gains, inheritance—everything.

The first reason this would be great is that it would dramatically simplify things—your tax form would basically involve you entering a single number, and getting out another number, the amount you owe in taxes.

The second reason this would be great is that every exception in the tax system presents the opportunity for someone with more wealth to pay accountants and lawyers to help them creatively exploit these loopholes and reduce their tax bill. Eliminating all the loopholes would entail that the rich play by the same rules—really, the single rule, a single formula—as everyone else.

Reason 2b for eliminating the possibility for loopholes is that this would dispose politicians of their chief commodity when bargaining with the rich—ie, as a legislator, you’d no longer be able to add a new tax law exception that happens to result in you getting a nice kickback or campaign contribution. (See James Buchanan’s Tax Reform as Political Choice for an argument for how politicians extract rent by opening loopholes to lobbyists).

The third reason to apply the tax equally to all earnings is that eventually, this would result in radical taxes on inheritance income.

One of the important alternatives on the table as we consider tax reform is a wealth tax, which presents a much greater opportunity for redistribution than an income tax. The problem with a wealth tax is similar to problems with new and radical consumption taxes — we do not have great mechanisms and measurement tools in place for levying wealth taxes.

But, a radical income tax that applies to inheritance, after a generation, eventually becomes a wealth tax.

The final reason I like the idea of eliminating lower tax rates on capital gains is that capital gains taxes disproportionately benefit the wealthy. I noted in my napkin model for the US govt there are valid concerns of “capital flight” that give me some pause in suggesting the elimination of special tax treatment of capital gains, but honestly the debate is a bit above my pay grade (btw, if you have interesting readings on this topic, please send them my way).

The Proposal / Interactive Model

I led with the desiderata / principles for income tax reform, rather than my specific proposal for a formula that satisfies the principles, since I am less attached to a specific implementation than I am interested in satisfying those first principles.

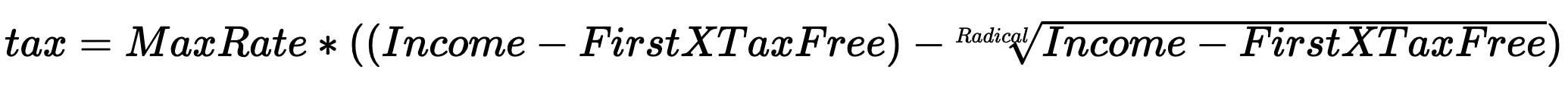

Here is a basic formula that satisfies the principles I laid out:

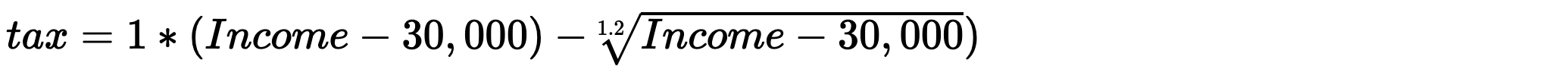

In the interactive model, I set the FirstXTaxFree parameter to $30k (roughly the 2016 living wage, annualized), Radical to 1.2, and MaxRate to 1.0 (it approaches 100% at the limit):

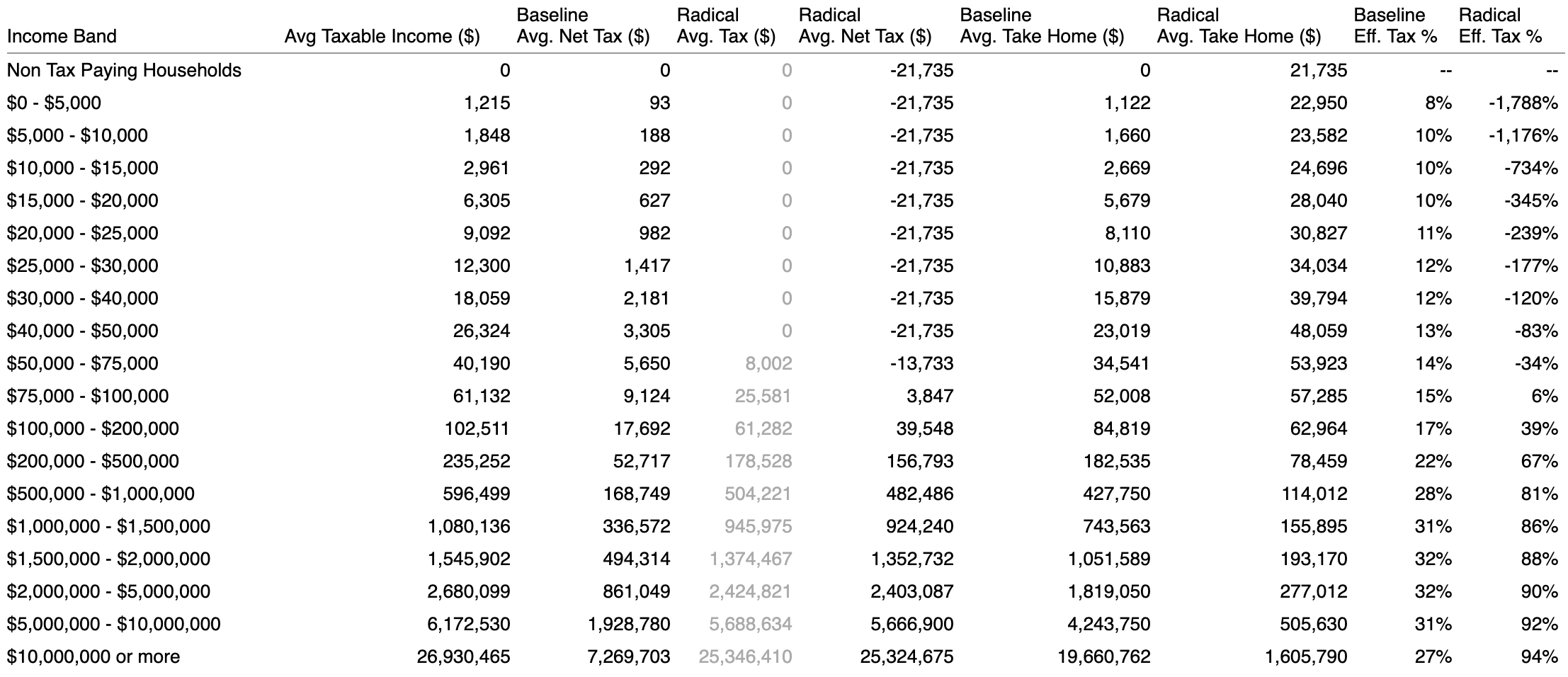

This results in a total of $4.2 trillion in tax revenue from $7.4 trillion in taxable income, a $2.7 trillion surplus over the baseline 2016 tax revenue. Distributing the surplus results in a ~$22k per capita share.

The average earning in bands up to the $50k-$75k income do much better off under this scenario, and then the effective rates ratchet up, with earners over $100k contributing more as a percentage of earnings than baseline:

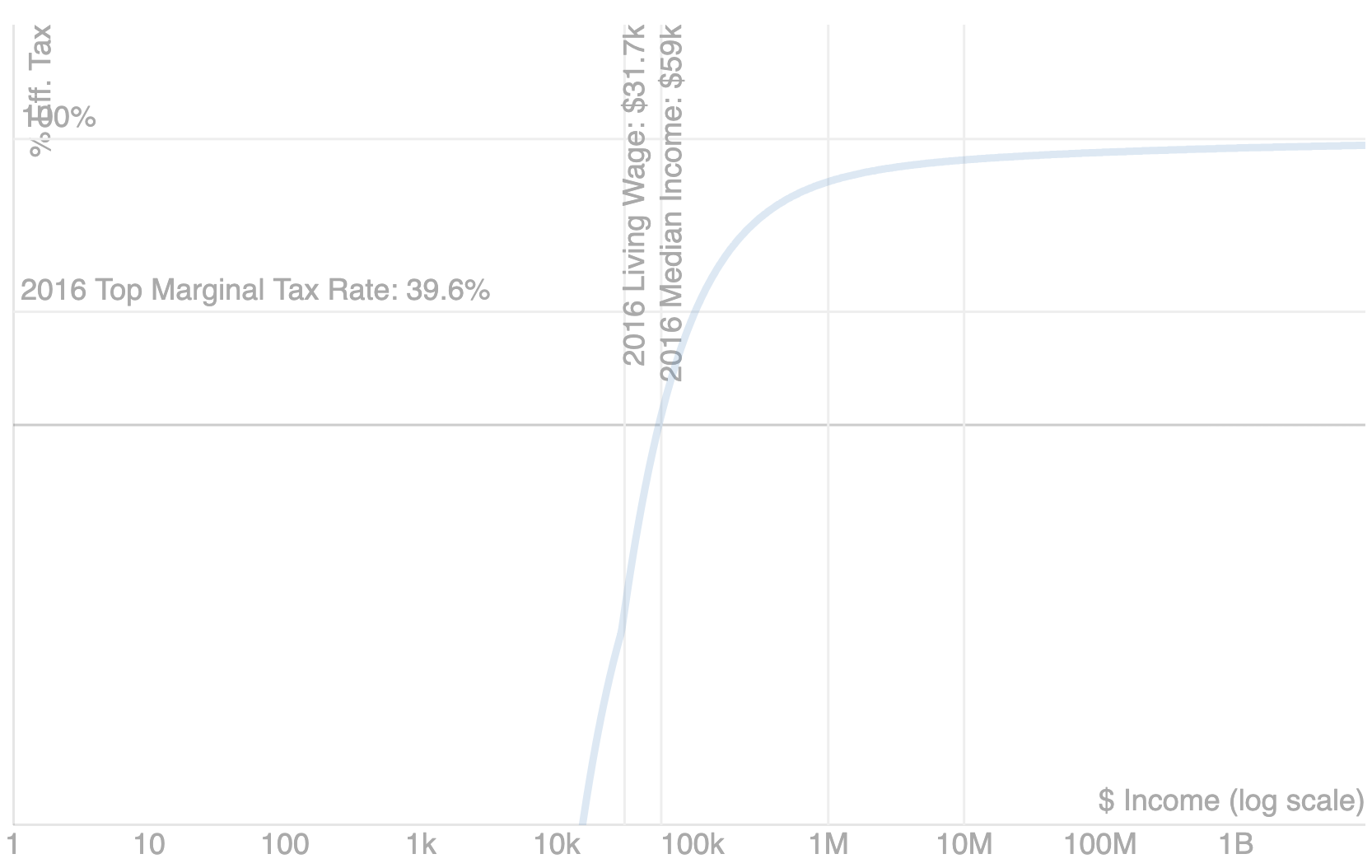

Here is the what the percent tax contribution as a function of earnings looks like:

After about $56k your effective tax rate goes above zero (your tax contribution exceeds your dividend). At around $350k you are paying 75% in taxes and by $3.5mm you are paying 90% in taxes. The curve asymptotes at 100% (although you can adjust this with the MaxRate parameter).

The interactive model allows you to toggle the key parameters, so you can see how they affect the redistribution.

Try out the interactive model here (it’s the best way to understand how tuning the parameters changes the results):

Considerations

Before concluding, I want to address a few considerations worth keeping in mind when evaluating this proposal.

(1) Many economists have argued that raising income tax rates past a certain threshold will cease to generate increased tax revenue, because it either (i) reduces the incentive to work or (ii) increases the incentive to avoid paying taxes (see the Laffer curve).

Re: (i) reduced incentive to work: we could tune the MaxRate parameter accordingly if this proved to be the case after initially setting it at or near 1.0 (although most of the ultra wealthy I have encountered seem more motivated by ego and relative status among their peers than by money in their bank account after a certain point, and I would personally bet that this incentive problem is more prevalent for middle/upper middle earners than the highest earners).

Re: (ii) avoiding taxes: Principle #5 is intended to reduce loopholes. One remaining loophole I imagine might still be exploited with the scheme as I laid it out would be for high earners to stop taking income and (i) to start financing their consumption as ‘business expenses’ (vs cashing out in the form of salary or dividends) or (ii) to finance their consumption via debt taken against their ownership share of a company, as Larry Ellison is mythologized to do. Both of these strategies would be more accessible to the wealthy (because they have access to more sophisticated accountants and lawyers), and this is one of the key drawbacks with this income tax proposal relative the tax on the exercise of power I proposed previously.

(2) A ‘feature’ of this proposal that might actually prove to be a ‘bug’ is eliminating tax loopholes by subjecting income of all types to the same tax rate. Because this strips politicians of an important currency (viz., the ability to create loopholes for their most generous backers), it might be impractical to gain support from politicians for such a tax.

(3) Another issue worth noting with my proposal is that I have completely ignored treatment of state and local taxes. But, I think you might be able to simply account for these by allowing state and local taxes to be deducted from this radically reformed federal income tax.

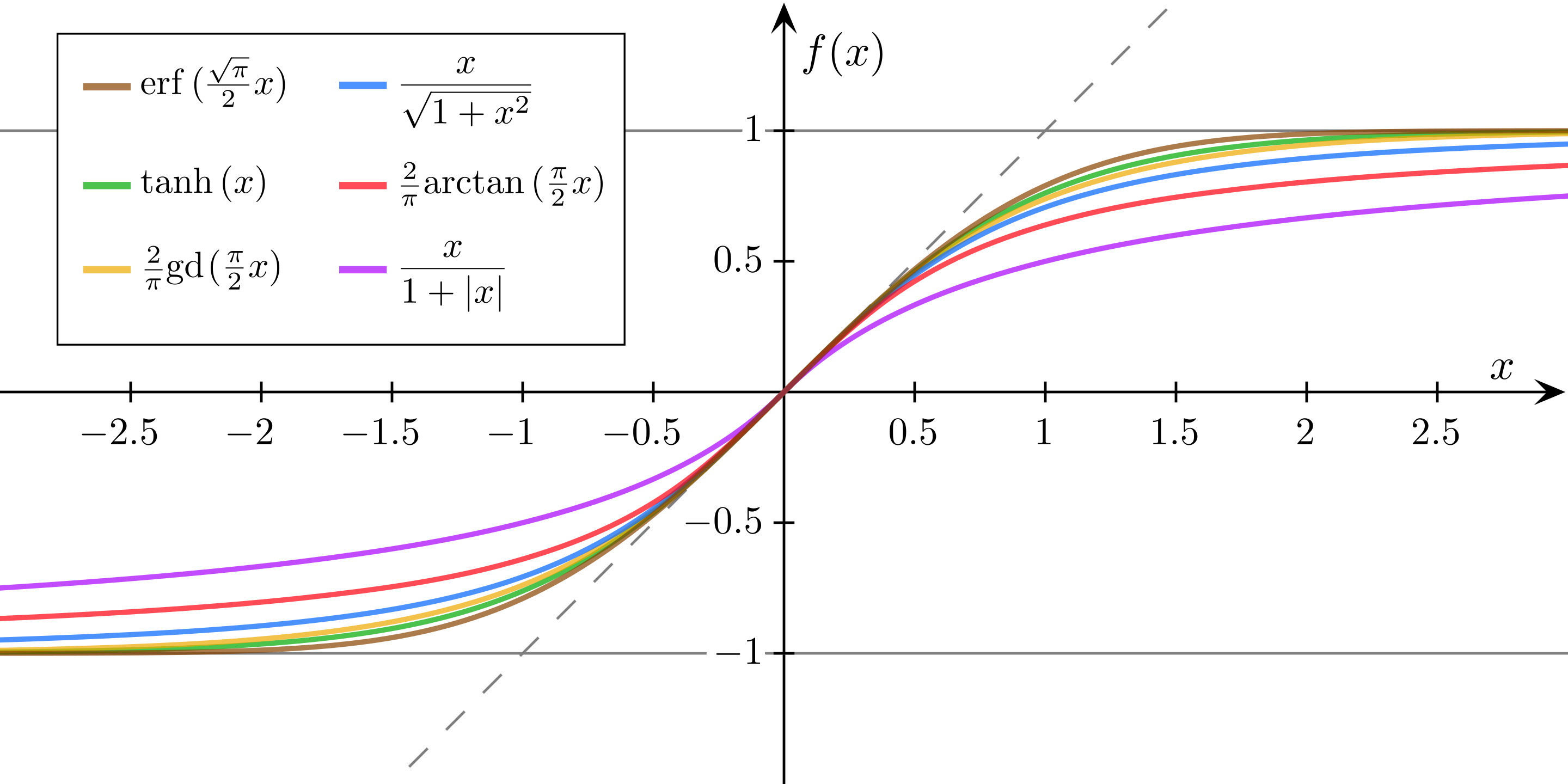

(4) Finally, the formula I proposed entails a higher rate of change in the tax rate for earners on the lower end of the income spectrum / close to the tax free floor and a decreasing rate of growth in the tax rate at the highest levels of income. It might be even better to design this tax using an ‘S curve,’ where the rate of increase in the percentage tax you pay increases slowly just after you start earning above the living wage / FirstXTaxFree parameter, then accelerates, and then starts decelerating again (probably at some point defined by a new SlopeEqualsOneAt parameter) at very high levels of earnings as it approaches the horizontal asymptote defined by the MaxRate parameter.

Takeaways

While I ultimately prefer the idea of taxing the exercise of power than taxing the accumulation of power, I think a radically reformed income tax could be a more practical way to achieve the same goal of dampening the acceleration of economic disparity and reducing the catastrophic risk to society posed by an extreme concentration of power.

The specific tax I have proposed here is no silver bullet, but I believe we can do far better as a society than our 20th century progressive tax scheme by radically reforming income taxes to satisfy the principles I have laid out in this essay.

Please use the interactive model to explore your own scheme and let me know if you come up with an S-curve model that you like (desmos is a pretty good tool for quickly exploring functions where you want to do more than change the basic parameters that are exposed as toggles in my interactive model).